Collegiate Financial Coach

Collegiate Financial Coach

Collegiate Financial Coach

Want to know your Out-of-pocket College costs before you go?

Want to know if you are on the right student loan repayment plan?

Helping Parents with College Planning and Funding

The cost of college has skyrocketed in recent years. In fact, over the past three decades, it has more than doubled! Finding an extra $40,000 or $50,000 or more can be hard to come by for many parents. For a considerable number, it may mean paying for college with money that should be going to fund their retirement or taking on student loan debt, which significantly restricts their future financial options.

However, what most parents don’t know is that there are strategies that they may be able to implement to reduce college costs. Proper college planning and funding should incorporate college selection, the financial aid process, income, assets, and tax strategies into one process. Our college planning and funding platform analyzes your financial situation to develop a customized plan detailing the most cost-efficient options to pay for college. Ultimately, we can help provide you some structure in your quest to afford college, which means greater peace of mind and an easier journey for your entire family.

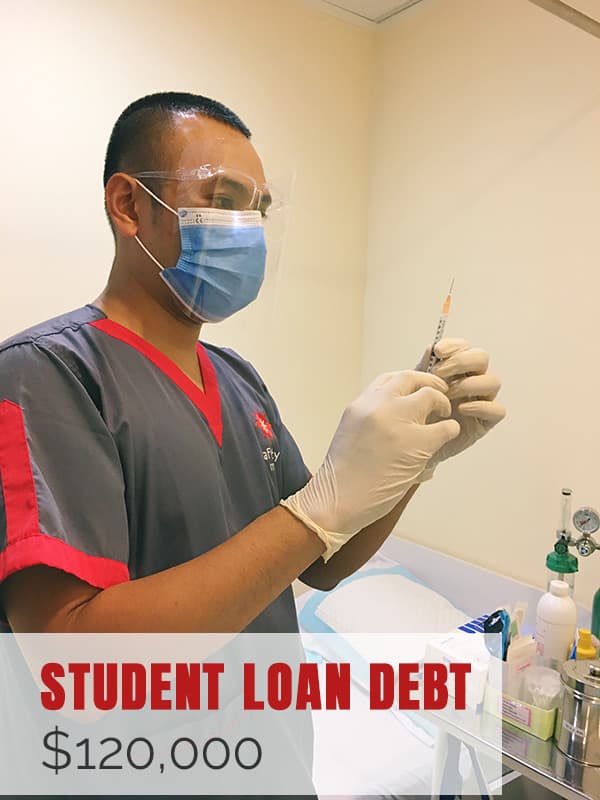

Helping Professionals with Student Loan Repayment

Americans owe a staggering $1.7 trillion – a record high, according to the Federal Reserve. As if this weren’t enough, student loan debt is projected to continue growing.

Many Americas who attended college took on debt with the hope of dramatically increasing their earning power after graduation. Others are on the hook for loans used to pay for their child’s education either by taking out PLUS loans (Parent Loans for Undergraduate Students) – federal funds borrowed by parents – or agreeing to be a co-signer on loans from private lenders. As a result, many borrowers are burdened by their student loan debt and don’t know where to turn to for help.

As a Consultant with Student Loan Planner, I help borrowers develop a game plan for paying off their student loan debt based on their unique financial needs and circumstances.