The cost of college continues to rise and many parents with college-bound students plan to borrow to pay for their child’s education. As a result, a new dilemma that we are seeing is that as college costs increase, parents are borrowing more, which can impact their retirement plans. In fact, the fastest-growing group of student loan borrowers are people over the age of 50. Therefore, my aim in this month’s newsletter is to help parents create a better funding and borrowing plan by increasing their knowledge about student loans. Below, I provide an overview of the federal student loans available by the U.S. Department of Education, as well as private loans.

Federal Direct Loans

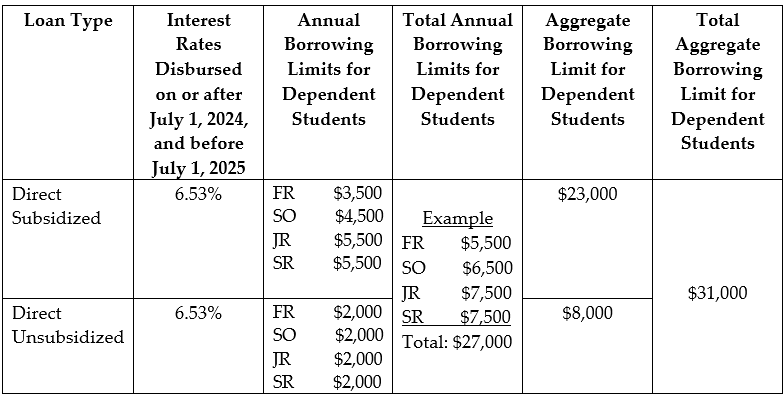

The Federal Direct Loan Program is the first loan option that families should consider. There are two loans that only students can borrow and there are limits to how much they can borrow. Below are the annual loan limits for dependent students:

The aggregate borrowing limit for a student who graduates college in four years is $27,000. If it takes the student longer than four years to graduate, the maximum borrowing amount is $31,000.

The two types of federal loans available to students are the Direct Subsidized Loan and the Direct Unsubsidized Loan. The difference between the two are as follows:

- Students who qualify for the subsidized loan don’t have to pay the interest that accrues on the loan while they are enrolled in college or during the six-month grace period after they graduate college or leave the school. In other words, the interest accrued from the moment of disbursement will be paid by the federal government.

- Students who borrow the unsubsidized loans are responsible for the interest accrual from the moment the loan is disbursed. However, they don’t have to begin paying the loans while they are enrolled in college. As with subsidized loans, payment begins after the six-month grace period or after they leave the college.

Therefore, the subsidized loan is superior to the unsubsidized loan.

How to Qualify for Direct Loans

Families must complete the FAFSA to determine their eligibility for Direct Loans. Eligibility for the subsidized loan requires a demonstrated financial need, whereas with the unsubsidized loan, financial need is not required.

Neither type of loan requires a parental co-signer, as it’s strictly a loan agreement between the student and the federal government.

The student will find out if they qualify for a subsidized loan when they receive their financial aid award. More specifically, the award letter will provide a breakdown of the subsidized and unsubsidized amounts.

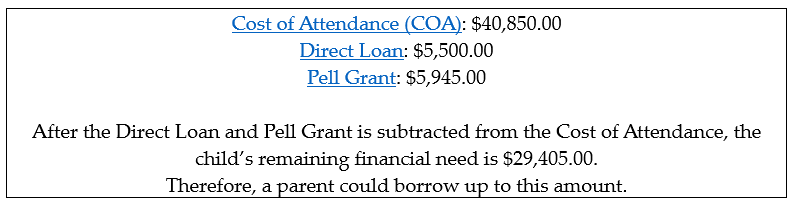

Below is an example of how both types of Direct Loans may appear on a financial aid award letter:

Parent Loan for Undergraduate Students (PLUS)

The federal government also offers a loan that only parents can borrow called the Parent Loan for Undergraduate Students, most commonly known as the Parent PLUS Loan. It is designed to allow parents to borrow the cost not covered by the child’s financial aid package. Parents can borrow the difference between a school’s Cost of Attendance (COA) and the amount of financial aid awarded. The remaining balance after the financial aid award amount is the maximum that a parent can borrow for that academic school year, as illustrated in the snippet below taken from the financial aid award above:

Eligibility is not based on financial need, but a credit check is required. Also, unlike Direct Loans for students, PLUS Loans do not have a maximum annual borrowing limit.

Now, while this may sound like a great option, it’s important to remember that you will eventually have to pay it back! One other thing that’s important to note is that if the parent is denied a PLUS Loan, the dependent student may be eligible for an increase in a Direct Unsubsidized Loan award.

Before borrowing Parent PLUS Loans, parents should know the following:

- It’s the parents’ loans, not the student’s loan.

- Generally speaking, it cannot be transferred to the student.

- The interest rate is set each year for all borrowers, so you will likely have loans with different interest rates if you borrow more than one academic year.

- You may qualify for loan forgiveness in the future via an Income-Driven Repayment (IDR) Plan.

- Federal loans have a death and disability benefit.

Private Loans

A private loan can be an attractive option for parents with very good credit histories. The interest rates on private loans can be lower than for PLUS Loans, which may make them a viable option. However, they don’t provide the same borrower or consumer protections offered by the federal government. Another issue with private loans is the underwriting process. Parents must apply for a new separate loan and get approved each year. As a result, the borrower’s debt-to-income ratio worsens over time, which often means they will have a higher interest rate. However, if the parent is able to pay the loan off quickly, they may be able to improve their credit history and qualify for lower interest rates.

Summary

Research all of your federal loan options first (i.e., Direct Subsidized, Direct Unsubsidized, and Direct PLUS loans). These typically offer more consumer protection and benefits than private loans (i.e., no credit check required for Direct Loans for students, lower and fixed interest rates, flexible payment options, deferment and forbearance options, etc.). Then consider private loans if necessary. In addition, as with all types of loans, it’s important to consider such factors as the fees, interest rates (variable or fixed), discharge policy (death or disability), prepayment penalties, etc. Additional components to consider is what the student and/or parent’s salary will be after graduation or when the student leaves school, as well as the type of employment the students will seek or the parents have (i.e., public service/non-profit/government entities may qualify for Public Service Loan Forgiveness).

In short, as college costs continue to rise, perhaps it’s now more important than ever that parents gain a better understanding of how to pay for college. The biggest problem that many families face is not developing and estimating a college funding plan to educate all of their children. Additionally, most families depend on high school guidance counselors and college financial aid offices for directions on financial aid. While these professionals are great resources, they generally cannot provide a complete financial picture. Paying for college is one of the most significant decisions that parents will make before retirement, yet many make the decisions on their own. With all of the increased complexities, one mistake can be worth thousands of dollars annually. Therefore, if you want to take a holistic approach to the college funding decision, we are here to help.